The Premier Advance Savings Plan is a policy which allows you to save an agreed amount on a regular basis, for a pre-agreed number of years.

Key Features:

- Save on a regular basis.

- First 18 months of payments used to purchase initial units.

- After 18 months, payments buy accumulation units.

- No entry cost for regular payments.

- Option to increase or decrease payments.

- Available in 5 major currencies.

- Payments can be monthly, quarterly, half yearly or yearly.

- Option to take a break from payments – ‘payment holiday’.

- Option to pay in lump sums.

- One-off or regular withdrawals.

- After 10 years a monthly bonus is applied to savings.

- Free of income and capital gains tax.

- Death benefit of 101%.

- Can be a solo or joint (up to 4 lives) account.

Minimums

- Minimum term is 5 years.

- Maximum term is 25 years.

- Extra pay ins have a minimum of €3,000 (amount varies by currency)

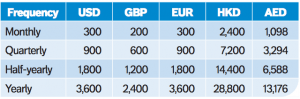

- Minimum extra pay in varies by frequency:

What to watch out for?

- Up to 100% penalty on initial units if you withdraw before end of plan term.

- Initial units have charge of 1.5%.

- Monthly plan fees.

- Lump sum pay in are subject to fee.

- More information can be found in the brochure – Friends Provident International Premier Advance Savings Plan.

It’s important to speak to an adviser to achieve the full potential, and benefits, of your bond.

How Harrison Brook can help and how are we different?

Whether you already hold a Premier Advance Savings Plan, or, are looking to open one, Harrison Brook can guide you through the entire process, and continue to manage your bond or alternative proposal throughout its life. We are:

- Fee-based and transparent: you will know every cost involved – allowing for the greatest returns.

- Online platform: allows you to track your investments, trades and savings – complete control.

- Continuous 5 star reviews for our Level 4 qualified Financial Advisers work.

- No restrictions on where you live – we are accessible and available worldwide.

- Free, no obligation initial consultation.

- All costs explained and cost-saving solutions proposed.

For more information, advice or to move your investment to Harrison Brook, contact us today.