What is an International SIPP?

A Self Invested Personal Pension (SIPP) is a type of pension plan that is very flexible and allows you to take control of your own investment decisions when saving for your retirement. If you no longer live in the UK, an International SIPP allows you to transfer and consolidate benefits from a UK registered pension schemes easily and efficiently to your new country of residence, while still protecting you under UK regulations.

You can take regular or variable income using an International SIPP with flexi access drawdown while still remaining invested. You are also not forced to buy an annuity.

Why have an International SIPP?

If you are a non-UK resident, then an International SIPP for expats gives you the ability to hold assets that are appropriate for international clients and also in other currencies, yet still meet the key UK Regulatory requirements.

The International SIPP gives you the freedom to appoint an authorised investment adviser or manager, or alternatively, you can manage the investments yourself.

7 Key Questions on the International SIPP

Want to find out more?

International SIPP eligibility: Who is an International SIPP suitable for?

The rule of thumb is that most expats can open an International SIPP, whether employed, self-employed, not working or retired. What is important to note is that where you have your main home determines the tax treatment of contributions into the scheme. If you are:

- An expat who is still a UK taxpayer, you’ll get pension contribution relief on the money set aside for retirement

- A tax resident elsewhere, you can still have a SIPP but will not have tax relief on your contributions.

But importantly in both of the above scenarios you can can take benefit (drawdown) in any country but it’s important to check what Dual Taxation Agreements (DTA) are in place with the UK and the country that you are residing with your financial adviser.

If you are an expat who eventually plans to retire to the UK, then an International SIPP may be still suitable for you also while you are abroad and when you eventually return. If, however, you are planning to retire abroad, a SIPP may not be the most appropriate pension solution for you depending on the Dual Taxation Agreements (DTA) in the country that you are residing and your retirement objectives, a QROPS maybe more suitable in certain circumstances where you are looking to protect yourself against lifetime allowance concerns. Please see our QROPS section below for more information.

Advantages of an International SIPP

The benefits of an International SIPP are many.

Investment Choice:

SIPP investments typically provide you with a much wider range of investment choice and flexibility, compared to a standard pension with its limited choice of funds typically overseen by the company’s own fund managers or a limited on panel fund range.

SIPP pension investment vehicles typically may include:

- Mutual funds

- Investment trusts

- Gilts

- UK and overseas stocks and shares

- Unlisted shares

- Insurance Bonds

- OEICs and unit trusts

- Exchange traded funds (ETFs)

- Property and land (not typically residential property).

Taxes:

SIPP Pension investments grow free of capital gains tax or income taxes.

Currency Choices:

Within an International SIPP you can hold your UK pension capital in all major currencies. For example, if you’re living in a European country, you can slowly convert your GBP pension capital into EUR for when you do start drawdown and taking benefit in retirement as you have no monthly currency risk. As you will be drawing down/withdrawing capital in the currency of the country that you reside in.

Want to find out more?

International SIPP vs QROPS: What are the differences?

Like an International SIPP, a QROPS (Qualifying Recognised Overseas Pension Scheme) is aimed at expats with existing UK pension rights.

The main difference is, however, that QROPS are typically suitable for you if you have a large pension pot (i.e you who are close to the Lifetime Allowance which is currently £1,073,00 for 2020/2021). As a QROPS can help mitigate future tax liabilities for exceeding the allowance when you come to draw benefits because a QROPS has no Lifetime Allowance limit compared to a UK pension such as a SIPP.

In the UK budget 2017, there was also a array of changes for QROPS particularly for expats who are residents outside of the EEA where an International SIPP would be the most prudent option.

Transfers to QROPS requested on or after the 9th March 2017 are subject to a 25% tax charge, unless;

- The QROPS is in the EEA and the Member is also resident in a EEA country.

- The QROPS and Member are in the same country or territory. This is a limited if negligible part of the market.

- The QROPS is an employer sponsored occupational scheme, overseas public service pension scheme or a pension scheme established by an international organisation.

To summarise, this means an International SIPP is often the best solution if you live outside of Europe even if you have a UK pension which exceeds the Lifetime Allowance limit, given the 25% overseas tax charge. Even if you live in Europe unless you have a UK pension nearing the Lifetime Allowance limit or over it, a QROPS could be a useful tax planning tool in that scenario.

Investment options – which are most appropriate for you?

This really depends on your own, unique, financial circumstances, as each of us are different and an investment option that is suitable for your work colleague or neighbour may not be the most appropriate investment option for you.

Not only do your financial circumstances influence the type of investment that is most suitable for you, but so does your attitude to risk, future priorities and so on. That is why seeking advice from an independent financial adviser who specialises in the expatriate financial market is important.

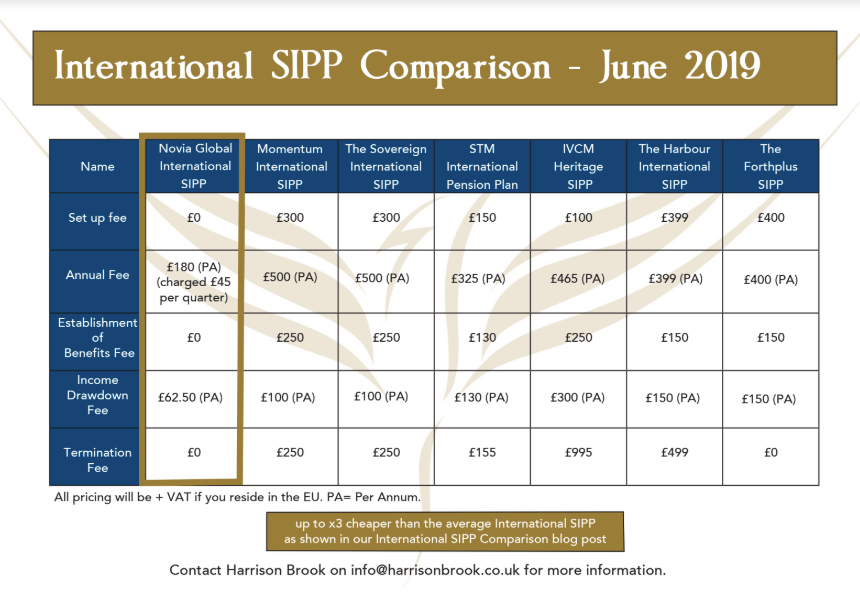

International SIPP Comparison – Fees

Fees can vary quite significantly from one International SIPP to another. More information can be found on our International SIPP comparison page.

How an International SIPP is also structured can also vary dramatically between different advisory companies, make sure you use a ‘fee-only’ financial adviser and not a ‘commission’ led advisory firm.

When evaluating costs between various SIPP providers, ensure to take into account all fees that may be added particularly if you are intending to start to take benefits and what investment structure is used within the International SIPP.

How to transfer an existing UK pension into an International SIPP

While the process of transferring an existing pension into an International SIPP is fairly straightforward, it is imperative that the transfer is done correctly and into a recognised and approved scheme.

Why choose Harrison Brook for your UK pension transfer over other advisory companies or a local financial adviser?

- Harrison Brook is a fully independent financial advisory company

- We are fully transparent working on a ‘fee’ only based model of advice – no commissions are taken, fees are explained clearly and from the outset to allow you to make an informed and educated decision on your UK pension transfer.

- UK regulated SIPP and platform – The highest protection

- Harrison Brook is fully regulated to provide cross-border financial advice

- Qualified and experienced financial advisers

- We can provide advice on all types of UK pensions, including personal, defined contribution (DC) and defined benefit (DB) pensions.

Using the services of Harrison Brook, specialists in expat financial advice and services, will make sure the transfer is done correctly and cost-effectively.

Want to find out more?