Confused by international expat retirement planning?

Over the past few years, more and more people have come to realise that they must examine their plan for retirement very carefully if they still wish to be able to retire at the age and income level they originally desired.

Gone are the days of your employer, or the state, looking after you in your ‘golden’ years. Ageing Western populations mean that employers and the state can simply no longer afford the once highly generous pension plans such as ‘defined benefit schemes’.

Why is Expat Retirement Planning so difficult?

Expats move from place to place and this transient lifestyle goes very much against their expat retirement planning needs. This often prevents them forming coherent financial plans, and retirement planning is commonly the key areas that suffers.

Currently, if you make use of an ‘indigenous’ domestic pension scheme, you may not gain access to the funds or move the money before reaching retirement age. What it means is that you build up small bits, in various places and companies, which do not add up to what you would have been entitled to if you had worked in an equivalent role, in one place, for an equivalent period of time.

It can also become very complex managing these numerous pension pots under different country’s state and employer systems. Some expats also find that they are unable to predict exactly where they will eventually retire. Whether they will remain an expat or return back home is often a difficult question to answer!

So, what is the solution?

An international private retirement plan to supplement your employer and state provision.

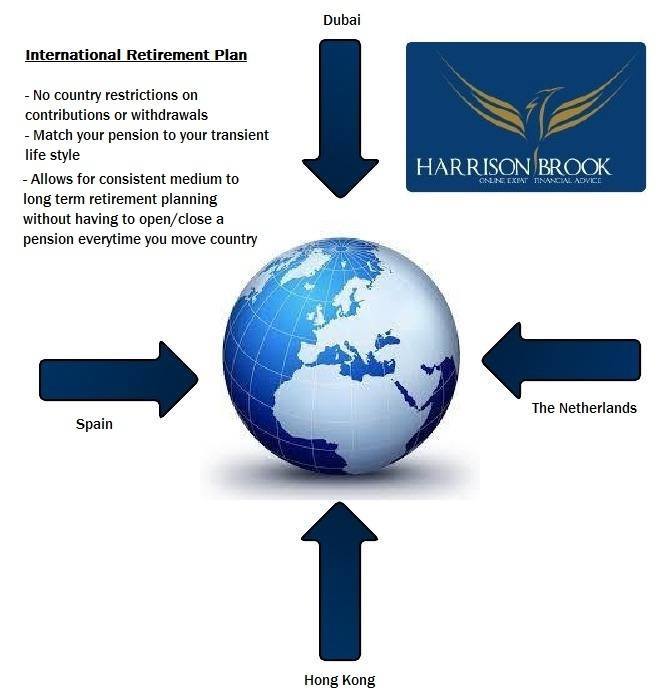

Offshore expat retirement planning offers a great solution to the transient expatriate who, just like their local counterpart, wishes to invest and make financial plans for his or her future. The inconvenience and disruption of needing to re-establish a new retirement plan every time you move country is negated by this geographically portable solution.

You are not restricted from which country you can contribute or upon retirement withdraw/encash. The plan stays in the same place while you move around, and it grows tax free the whole time, in a tax efficient investment area.

This is the perfect solution to any expatriate’s long term retirement investment need.

The cost of delay: How confident are you that you’ll achieve the retirement you want?

Why choose Harrison Brook for your International Expat Retirement Planning?

- We offer discounted international retirement plans through our online advice system – we pass the savings onto you

- Expat retirement planning products available from a range of the world’s largest banking institutions

- We are cross border international specialists – ideal solution for contractors, oil & gas workers or any transient expat worker

- UK regulated adviser

- Ongoing advice and management

- No restrictions on client location

- Access to funds that have been handpicked by investment specialists in model portfolios which can be structured for capital growth, income generation or both