UK Pension Transfers – France QROPS or SIPP

Do you live, are retired or work in the France? Wondering how to transfer or consolidate your UK pensions?

Is a France QROPS or a SIPP right for me?

QROPS (Qualifying Overseas Pension Schemes) or SIPP (Self Invested Personal Pensions) allow for the transfer, and subsequent management of UK pensions to a personal pension structure. This includes UK frozen pensions.

It will allow you to consolidate all of your current pensions into a single pension structure.

If you have savings in an existing UK pension fund but are considering retiring abroad/in France, you may be wondering just how easy it will be to access these funds. The dreams of a more relaxed lifestyle or the attraction of lower tax could soon fade if you have to work around pension rules more relevant to UK.

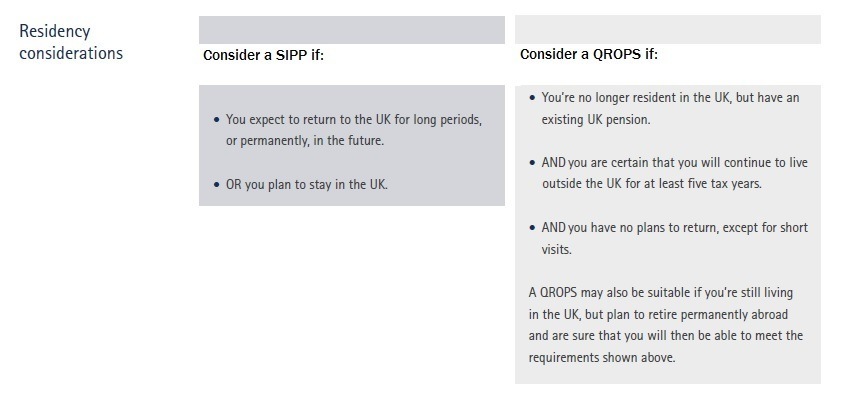

However, if you already live outside the UK, or you’re planning to move overseas shortly for a period of five years or more, you can use a QROPS to transfer your pension arrangements abroad. If your intention is to retire in the UK a SIPP structure would be more suitable.

Benefits

- No 55% tax charge for beneficiaries (QROPS)

- Consolidate several pensions into one pot/place (Including personal & employee based schemes)

- No annuity purchase necessary

- A QROPS can provide for your family, it is possible to use up to 100% of the fund to provide a spouses pension

- 100% of pension pot can be left for beneficiaries

- Wider range of investments to choose from

- Tax free lump sum

- Receive pension income free from UK income tax (QROPS)

- Low cost charging structures

What you should consider before choosing a QROP or a SIPP?

- Residency considerations: do you expect to return to the UK to retire or for long periods of time in the future?

- Existing pension arrangements:

- Is your current pension plans worth less than £75,000?

- Are you current pensions defined benefit schemes?

- Do your existing schemes include benefits such as spouse’s pension, life cover, competitive charges?

Harrison Brook helping you make the best choices:

UK pension transfers are a growing market, and new QROPS/SIPP providers are appearing regularly. Talk to a financial adviser to make sure you choose the most appropriate jurisdiction and QROPS or SIPP provider for your needs. Additionally your SIPP or QROPS will include different kinds of investments, it is crucial to speak to a financial adviser to match your investment portfolio to your risk profile and growth expectations.

Why choose Harrison Brook for your pension transfer?

- QROP & SIPP structures available depending on your situation

- We offer discounted QROP & SIPP fee structures through our online advice system – we pass the savings onto you

- If you prefer to meet an adviser on a face to face basis this can also be arranged

- UK regulated adviser

- Ongoing advice and management

- No restrictions on client location

- Access to institutional high rate deposit accounts and structured fixed return products

- Access to funds that have been handpicked by investment specialists in model portfolios which can be structured for capital growth, income generation or both

How do you get started and take the first step?

To get the latest valuations of your pensions and to discuss a pension transfer with a UK regulated adviser, including the benefits if a QROP or a SIPP is the solution for your pension planning. Click ‘Get Started‘, speak to an adviser for free, no obligation, financial analysis and information.

You can also request a free guide to UK Pension Transfers by contacting us.